Evaluating the Impact of Corporate Governance on Bank Risk and Financial Stability in Sub-Saharan Africa: A CAMELS-Based Empirical Analysis

Abstrak

Purpose: To investigate the influence of corporate governance structures—specifically board size, board independence, CEO duality, and ownership concentration—on bank risk and financial stability in Sub-Saharan Africa, using the CAMELS framework.

Method: The study employs a quantitative explanatory design with panel data regression analysis on a purposive sample of listed commercial banks in Kenya, Nigeria, Ghana, and South Africa from 2014 to 2024. Key risk dimensions (CAR, NPL, MGT, ROA, LIQ, SENS) are assessed using secondary data from annual reports, central bank supervision documents, World Bank research, and IMF databases. Analytical tools include fixed effects regressions, the Hausman test, and Saylor standard errors.

Findings: The study shows that board independence reduces credit risk and strengthens capital buffers, while CEO duality leads to riskier behavior and weaker oversight. Ownership concentration yields mixed effects: moderate levels enhance oversight, while excessive concentration heightens risk. These effects are statistically robust across varying economic and regulatory conditions.

Implication: The findings provide actionable insights for bank boards, regulators, and policymakers seeking to enhance governance frameworks and maintain financial stability, particularly in the context of evolving macroeconomic and regulatory conditions. Future research could explore how emerging governance innovations—such as ESG integration or digital board practices—further influence bank stability in developing regions.

Originality: This paper presents a region-specific, empirically grounded analysis of governance and risk in SSA banks, integrating the CAMELS framework with robust econometric techniques using a decade-long panel dataset. This approach remains underexplored in existing literature.

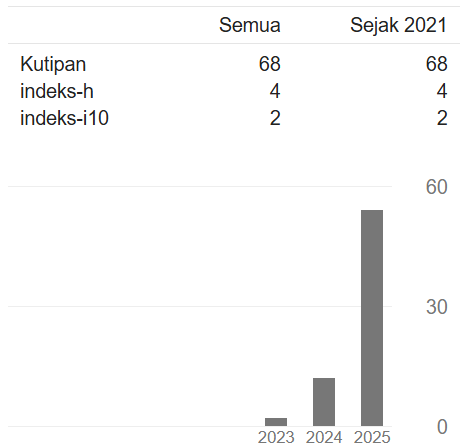

##plugins.generic.usageStats.downloads##

Referensi

Abdulwahab, A. I., Bala, H., Yahaya, O. A., & Abdullahi, M. (2023). Corporate Governance Committees and Sustainability Reporting of Listed Consumer Goods Firms in Nigeria. International Journal of Research and Innovation in Social Science, 7(7), 1761-1770. http://dx.doi.org/10.47772/IJRISS.2023.70836

Abor, J., Adjasi, C. K. D., & Hayford, C. (2019). Corporate governance and bank risk-taking in Ghana. Corporate Governance: The International Journal of Business in Society, 19(5), 1066–1080. https://doi.org/10.1108/CG-02-2019-0051

Adams, R. B., & Mehran, H. (2012). Bank board structure and performance: Evidence for large bank holding companies. Journal of Financial Intermediation, 21(2), 243–267. https://doi.org/10.1016/j.jfi.2011.09.002

Adegbite, E. (2015). Good corporate governance in Nigeria: Antecedents, propositions and peculiarities. International Business Review, 24(2), 319–330. https://doi.org/10.1016/j.ibusrev.2014.08.004

Aebi, V., Sabato, G., & Schmid, M. M. (2012). Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking & Finance, 36(12), 3213–3226. https://doi.org/10.1016/j.jbankfin.2011.10.020

Basel Committee on Banking Supervision. (2015). Corporate governance principles for banks. Bank for International Settlements. https://www.bis.org/bcbs/publ/d328.pdf

BCBS (2015). Basel Committee on Banking Supervision Consultative document: Guidelines Corporate governance principles for banks. https://www.bis.org/publ/bcbs294.pdf

Beck, T., & Keil, J. (2022). Have banks caught corona? Effects of COVID on lending in the US. Journal of Corporate Finance, 72, 102160. https://doi.org/10.1016/j.jcorpfin.2022.102160

Beltratti, A., & Stulz, R. M. (2012). The credit crisis around the globe: Why did some banks perform better? Journal of Financial Economics, 105(1), 1–17. https://doi.org/10.1016/j.jfineco.2011.12.005

Bencharles, K. O., & Nwankwo, C. D. (2021). Credit Risk Management and Deposit Money Banks’ Stability in Nigeria: Does Good Corporate Governance Matter? Research Journal of Finance and Accounting, 12(16), 1–14. http://dx.doi.org/10.7176/RJFA/12-16-01

Benti, D. W., Birru, W. T., Tessema, W. K., & Mulugeta, M. (2022). Linking Cultural and Marketing Practices of (Agro) pastoralists to Food (In) security. Sustainability, 14(14), 8233. https://doi.org/10.3390/su14148233

Castellano, G. G. (2024). Don’t call it a failure: systemic risk governance for complex financial systems. Law & Social Inquiry, 49(4), 2245–2286. https://doi.org/10.1017/lsi.2024.8

Chironna, G., Orlando, G., & Penikas, H. (2023). At night, all cats are grey, but at day they are not: Default (PD) forecasts capturing Italian banks’ idiosyncrasy. Available at SSRN 4141518. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4141518

Claessens, S., & Yurtoglu, B. B. (2013). Corporate governance in emerging markets: A survey. Emerging markets review, 15, 1-33. https://doi.org/10.1016/j.ememar.2012.03.002

Clark, T., Foster, L., Bryman, A., & Sloan, L. (2021). Bryman’s social research methods. Oxford University Press.

Dada, S. A., Igbekoy, O. E., & Dagunduro, M. E. (2023). Effects of Forensic Accounting Techniques and Corporate Governance on the Financial Performance of Listed Deposit Money Banks in Nigeria. International Journal of Professional Business Review: Int. J. Prof. Bus. Rev., 8(10), 8. https://doi.org/10.26668/businessreview/2023.v8i10.3547

Deda, G., Mehmeti, I., Tërstena, A., & Bislimi, F. (2025). Steering stability: Governance determinants and the banking business insight from southeastern European countries. Multidisciplinary Science Journal, 7(5), 2025254-2025254. https://doi.org/10.31893/multiscience.2025254

Desta, T. S. (2016). Financial performance of “The best African banks”: A comparative analysis through CAMEL rating. Journal of accounting and management, 6(1), 1-20. https://hrcak.srce.hr/162948

Erkens, D. H., Hung, M., & Matos, P. (2012). Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), 389–411. https://doi.org/10.1016/j.jcorpfin.2012.01.005

Ghanad, A. (2023). An overview of quantitative research methods. International journal of multidisciplinary research and analysis, 6(08), 3794–3803. https://doi.org/10.47191/ijmra/v6-i8-52

Ghosh, S. (2016). Political connections and earnings management in emerging market banks: Evidence from India. Corporate Governance: An International Review, 24(2), 184–203. https://doi.org/10.1111/corg.12127

Herbert, W. E., & Agwor, T. C. (2021). Corporate Governance Disclosure and Corporate Performance of Nigerian Banks. Journal of Research in Emerging Markets, 3(3), 14–36. https://doi.org/10.30585/jrems.v3i3.674

Hutapea, A. A. B., & Sulistyowati, E. (2024). The Role of Agency Cost as a Mediator in the Effect of Capital Structure on Company Financial Performance. Indonesian Journal of Sustainability Policy and Technology, 2(1), 1-18. https://doi.org/10.61656/ijospat.v2i1.160

IMF (2020), A year like no other: IMF Annual Report 2020. https://www.imf.org/external/pubs/ft/ar/2020/eng/downloads/imf-annual-report-2020.pdf

Jensen, M.C., Meckling, W.H. (1979). Theory of the Firm: Managerial Behavior, Agency Costs, and Ownership Structure. In: Brunner, K. (eds) Economics, Social Institutions. Rochester Studies in Economics and Policy Issues, vol 1. Springer, Dordrecht. https://doi.org/10.1007/978-94-009-9257-3_8

Kafidipe, A., Uwalomwa, U., Dahunsi, O., & Okeme, F. O. (2021). Corporate governance, risk management and financial performance of listed deposit money banks in Nigeria. Cogent Business & Management, 8(1), 1888679. https://doi.org/10.1080/23311975.2021.1888679

Kittur, J. (2023). Conducting a quantitative research study: A step-by-step process. Journal of Engineering Education Transformations, 100-112. https://journaleet.in/index.php/jeet/article/view/290

Kyere, M., & Ausloos, M. (2020). Corporate Governance and risk-taking in Ghanaian Banks. Journal of Risk and Financial Management, 13(10), 235. https://doi.org/10.3390/jrfm13100235

Laeven, L., & Levine, R. (2009). Bank governance, regulation and risk taking. Journal of Financial Economics, 93(2), 259–275. https://doi.org/10.1016/j.jfineco.2008.09.003

Lawrence, B., Doorasamy, M., & Sarpong, P. (2022). The Impact of Credit Risk on Performance: A Case Study of South African Commercial Banks. Global Business Review, 25(2_suppl), S151-S164. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3744102

Love, I., & Rachinsky, A. (2015). Corporate governance, ownership, and bank performance in emerging markets: Evidence from Russia and Ukraine. Emerging Markets Finance and Trade, 51(2), 57–72. https://doi.org/10.1080/1540496X.2015.1011522

Mensah-Dadzie, E. R. I. C. (2022). Analysis of Factors Affecting the Profitability of Commercial Banks in Ghana: The Camel Approach. https://ir.uew.edu.gh/handle/123456789/2351

Minton, B. A., Taillard, J. P. A., & Williamson, R. (2014). Financial expertise of the board, risk taking, and performance: Evidence from bank holding companies. Journal of Financial and Quantitative Analysis, 49(2), 351–380. https://doi.org/10.1017/S0022109014000283

Mollah, S., & Zaman, M. (2015). Shari’ah supervision, corporate governance, and performance: Conventional vs. Islamic banks. Journal of Banking & Finance, 58, 418-435. https://doi.org/10.1016/j.jbankfin.2015.04.030

Moses, O. O. (2021). Corporate Governance and Economic Sustainability Reporting in Nigeria Journal of Accounting and Taxation, 13(4), 243–254. https://academicjournals-org.webpkgcache.com/doc/-/s/academicjournals.org/journal/JAT/article-full-text-pdf/F61187867810

Muslimin, M., & Hasnatika, A. S. (2024). Changes in Banking Industry Stock Prices: The Role of Risk, Good Governance, Earnings, and Capital . Sustainable Business Accounting and Management Review, 6(1), 1-11. https://doi.org/10.61656/sbamr.v6i1.58

Ntim, C. G., Lindop, S., & Thomas, D. A. (2017). Corporate governance and risk reporting in South Africa. Corporate Governance: An International Review, 25(2), 106–128. https://doi.org/10.1111/corg.12140

Olateju, D. J., & Tijani, B. R. (2024). Effect of Corporate Governance on Banking System Stability in Nigeria. International Journal of Business Studies, 8(2), 144-159. https://journal.uir.ac.id/index.php/ijbs/article/download/22382/8484/85002

Olawale, A. (2024). Capital adequacy and financial stability: A study of Nigerian banks’ resilience in a volatile economy. GSC Advanced Research and Reviews, 21(1), 001-012. http://dx.doi.org/10.30574/gscarr.2024.21.1.0346

Oredegbe, A. (2022). Competition and banking industry stability: How do BRICS and G7 compare? Journal of Emerging Market Finance, 21(1), 7–31. https://doi.org/10.1177/09726527211045759

Parent, O., & LeSage, J. P. (2012). Spatial dynamic panel data models with random effects. Regional Science and Urban Economics, 42(4), 727-738. https://doi.org/10.1016/j.regsciurbeco.2012.04.008

Peni, E., & Vähämaa, S. (2012). Did good corporate governance improve bank performance during the financial crisis? Journal of Financial Services Research, 41(1–2), 19–35. https://doi.org/10.1007/s10693-011-0108-9

Saka, A. Q., & Xin, Z. (2025). Evidence on the impact of corporate governance on bank performance from deposit money banks in Sub-Saharan Africa. International Journal of Business Sustainability,1(1), 44–66. https://journal.uir.ac.id/index.php/ijbs/article/view/22382

Saunders, M.N.K., Lewis, P., & Thornhill, A. (2019). Research Methods for Business Students. 8th Edition, Pearson, New York.

Singh, Y., & Milan, R. (2023). Analysis of Financial Performance of Public Sector Banks in India: The CAMEL Approach. Arthaniti: Journal of Economic Theory and Practice, 22(1), 86–112. https://ideas.repec.org/a/sae/artjou/v22y2023i1p86-112.html

Usman, S. O., & Yahaya, O. A. (2023). Corporate Governance and Credit Ratings in Nigeria. Int Journal of Economics, Management and Finance, 2(1), 62-71. https://zenodo.org/records/8246476

Walliman, N. (2022). Research methods: The basics. Routledge.

##submission.copyrightStatement##

##submission.license.cc.by4.footer##