Cooperative Financial Performance Analysis of Liquidity, Solvency, Profitability, and Activity Ratios

(A Case Study of the Tirta Dharma PDAM Cooperative in Samarinda City based on Ministerial Regulation Number 06/Per/M.KUKM/V/2006)

Abstract

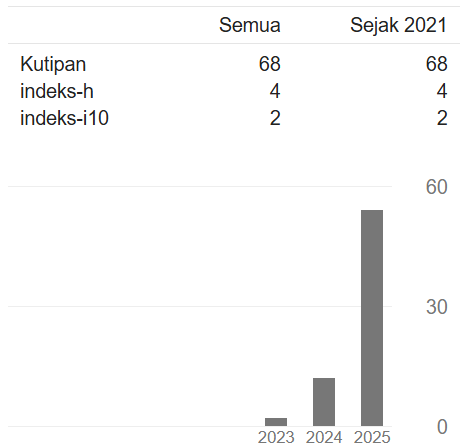

Cooperatives have an essential role in constructing national economic development, and their financial analysis is needed to evaluate the efficiency of their financial performance. This study aims to evaluate cooperatives' profitability, solvency, liquidity, and activity ratios in the years 2016–2018. The results will be analyzed using trend lines to determine if cooperative financial performance increased or decreased during that time. In this study, researchers employ liquidity ratios, specifically current ratios, as analytical tools. Solvency Ratios consist of Total Debt to Equity Ratio and Total Debt to Assets Ratio. Activity Ratios using ratios—accounts receivable turnover—and Profitability Ratios comprising Economic Profitability, Return on Assets, and Net Profit Margin. The study's findings and the subsequent discussion demonstrate that the results were excellent when the liquidity ratio was calculated using the current ratio from 2016 to 2018. The solvency ratio is excellent based on the Total Debt to Equity Ratio and Total Debt to Assets Ratio. Both the total debt-to-equity ratio and the total debt-to-total assets ratio show annual rises in their trend graphs. Economic profitability, return on assets, and net profit margin are used to calculate the profitability ratio, which yields excellent results. The Receivables Turnover ratio calculates the Activity Ratio, which yields subpar results. This analysis suggests that to raise activity ratios, attention should be paid to asset and operational management solutions that are more effective.

Downloads

References

Dewi, D. K. R., & Abundanti, N. (2021). The Effect of Liquidity, Solvency and Activities on Profitability in Saving and Loan Cooperatives (SLC) in Klungkung Regency, Bali, Indonesia. European Journal of Business and Management Research, 7(1), 324–328. https://doi.org/10.24018/ejbmr.2022.7.1.1245

Fahmi, I. (2018). Pengantar Manajemen Keuangan Teori dan Soal Jawab (Cetakan Keenam). Bandung: Alfabeta.

Gulo, I. R. P., Bate’e, M. M., & Telaumbanua, Y. N. (2022). Analisis Kinerja Keuangan Koperasi Pada Koperasi Konsumen Tokosa Sahabat Sejati Kota Gunungsitoli. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis Dan Akuntansi, 10(4), 1436–1444. https://ejournal.unsrat.ac.id/v3/index.php/emba/article/view/43970

Hanafi, H., & Halim, H. (2016). Analisis Laporan Keuangan. Yogyakarta: YKPN.

Haykal, H., Negoro, T., & Adeline, L. (2021). Revitalization of Funding for Savings and Loans Cooperatives as Efforts to Improve the State’s Economy after the Covid-19 Pandemic. Yustisia Jurnal Hukum, 10(2), 124–144. https://doi.org/10.20961/yustisia.v10i2.50438

Kasmir. (2016). Analisis Laporan Keuangan. Jakarta: Raja Grafindo Persada.

Kontogeorgos, A., Sergaki, P., Kosma, A., & Semou, V. (2018). Organizational Models for Agricultural Cooperatives: Empirical Evidence for their Performance. Journal of the Knowledge Economy, 9(4), 1123–1137. https://doi.org/10.1007/s13132-016-0402-8

Kuznetsova1, N. A., Ilyina1, A. V., Korolkova, A. P., & Marinchenko, T. E. (2021). Agricultural consumer cooperatives in Russia: state and prospects for development. IOP Conference Series: Earth and Environmental Science, Volume 677, IV International Scientific Conference: AGRITECH-IV-2020: Agribusiness, Environmental Engineering and Biotechnologies 18-20 November 2020, 677. https://doi.org/https://iopscience.iop.org/article/10.1088/1755-1315/677/2/022043/meta

Mardhiyah, S., & Saifuddin, M. (2022). Analisis Kinerja Keuangan Untuk Mengukur Tingkat Kesehatan Keuangan Pada KPRI WARPEKA (Warga Pendidikan dan Kebudayaan) Gresik Periode Tahun 2019-2020. Business Management Analysis Journal (BMAJ), 5(1), 43–61. https://doi.org/10.24176/bmaj.v5i1.7065

Martínez‐Victoria, Mc., Arcas Lario, N., & Maté Sánchez Val, M. (2018). Financial behavior of cooperatives and investor‐owned firms: An empirical analysis of the Spanish fruit and vegetable sector. Agribusiness, 34(2), 456–471. https://doi.org/10.1002/agr.21513

Pangestu, P. A., & Hastuti, S. (2021). Pengaruh Kualitas Sumber Daya Manusia Terhadap Kualitas Laporan Keuangan Pada Koperasi. Small Business Accounting Management and Entrepreneurship Review, 1(1), 35–45. https://doi.org/10.61656/sbamer.v1i1.49

Pariyanti, E., & Zein, R. (2018). Analisis Kinerja Keuangan pada Koperasi Simpan Pinjam dan Pembiayaan Syariah BMT Sepadan Kecamatan Pasir Sakti Lampung Timur. Fidusia Jurnal Ilmiah Keuangan Dan Perbankan, 1(2), 1–19. https://fe.ummetro.ac.id/ejournal/index.php/JPK/article/view/303

Rahman, F., & Pratikto, H. (2022). Sibisa Al Khairat Pamekasan Cooperative Financial Ratios During the Pandemic. International Journal of Multicultural and Multireligious Understanding (IJMMU), 9(6), 445–454. https://ijmmu.com/index.php/ijmmu/article/view/3781

Ramadhan, A. Z., & Suryaningrum, D. H. (2020). Analisis Penerapan Prinsip Good Governance pada Kinerja Keuangan Organisasi Nirlaba. Public Management and Accounting Review, 1(1), 1–9. https://doi.org/10.61656/pmar.v1i1.18

Republik Indonesia. (2006). Peraturan Menteri Koperasi dan KUKM NO.06/PER/M.KUKM/V/2006 tentangPedoman Penilaian Koperasi Berprestasi. Kementerian Koperasi dan KUKM.

Rondós-Casas, E., Linares Mustarós, S., & Farreras Noguer, M. À. (2018). Expansion of the current methodology for the study of the short-term liquidity problems in a sector. Intangible Capital, 14(1), 25–34. https://doi.org/10.3926/ic.1085

Suratiningsih, S. (2019). Analisis Kinerja Keuangan Pada KPRI KOKELGAM Berdasarkan Analisis Rasio Keuangan Tahun 2013-2017. Jurnal Perilaku Dan Strategi Bisnis, 7(1), 76–90. https://doi.org/10.26486/jpsb.v7i1.676

Warda, N., Caska, & Haryana, G. (2017). Analisis Kinerja Keuangan Koperasi pada Koperasi Serba Usaha (KSU) Rejosari Kelurahan Rejosari Kecamatan Tenayan Raya Kota Pekanbaru. Jurnal Online Mahasiswa (JOM) Fakultas Keguruan dan Ilmu Pendidikan, 4(2), 1–12. https://jnse.ejournal.unri.ac.id/index.php/JOMFKIP/article/view/14562

Wulandari, Y. E. (2018). Analisis Kinerja Keuangan Koperasi Simpan Pinjam (KSP) Mitra Sejahtera Abadi Pakem Sleman Yogyakarta. Jurnal Ekobis Dewantara, 1(8), 24–33. https://jurnalfe.ustjogja.ac.id/index.php/ekobis/article/view/528

Yuni, R., Thohiri, R., Hastuti, P., & Silaban, P. S. M. J. (2019). Initiating the Implementation of Basic Principles of Good Cooperative Governance In the Value Chain Financial Management at the Cooperative of Fajar Surya Mandiri in the District of Simalungun. Journal of Community Research and Service, 2(2), 231–235. https://doi.org/10.24114/jcrs.v2i2.13173

Copyright (c) 2023 Hamsyah Hamsyah, Imam Nazarudin Latif, Catur Kumala Dewi

This work is licensed under a Creative Commons Attribution 4.0 International License.