Merger dan Acquisition in Vietnam: Impact on Wealth, Quality of Governance, and Policy Implications in Emerging Markets

Abstract

Purpose: To understand the impact of mergers and acquisitions (M&A) in Vietnam, with particular emphasis on the differences between the intended and acquired companies, this study also considers institutional, regulatory, and macroeconomic variables that may influence the results.

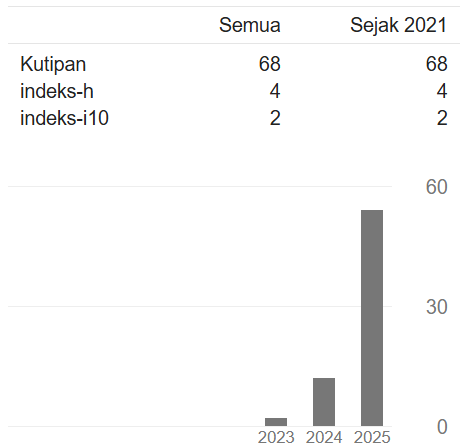

Method: The study analyzed twenty relevant articles published between 2015 and 2025. The method used was a descriptive-analytical literature review. To identify the elements, differences, and variables influencing the wealth effects of M&A in Vietnam, these articles were assessed comparatively and thematically.

Findings: This study shows that as a result of the acquisition premium, target shareholders often experience unusually positive returns; conversely, acquirer shareholders often experience neutral or negative returns, supporting agency theory. Foreign investors, information asymmetry, regulatory uncertainty, and transaction aspects such as deal size and cross-border nature are some examples of moderating factors.

Implication: These results suggest that improving M&A outcomes in emerging markets requires improved corporate governance, greater regulatory clarity, and market transparency. While practitioners recommend that policymakers prioritize macroeconomic stabilization and enhancing investor protection mechanisms, post-merger integration and in-depth due diligence should be a top priority.

Originality:These results suggest that to improve M&A outcomes in emerging markets, better corporate governance, greater regulatory clarity, and market transparency are necessary.

Keywords: Mergers and Acquisitions, Corporate Management, Wealth Effect, Emerging Markets.

Downloads

References

Bui Hong Diep & Tung Tran Anh. (2020). Synergies in merger & acquisition: A case study of SMEs in Vietnam. Journal of Project Management. https://doi.org/10.5267/j.jpm.2020.6.001.

Cao, D. K., Le, T. P., Tran, T. K. A., & Nguyen, B. T. (2016). The effect of partial merger & acquisition activities on target firm’s performance: a case study from banking and finance industry in Vietnam. Journal of International Economics and Management, 83, 27-34. https://jiem.ftu.edu.vn/index.php/jiem/article/view/145

Cao Thi Huyen Trang, Dang Ngoc Hung, Nguyen Thi Thu Thuy, Vu Viet Thang, Le Quoc Huy, & Chi Thi Huyen (2024). Impact of Mergers and Acquisitions on the Financial Performance of Vietnamese Firms. Corporate Finance - Journal of Finance & Accounting Research, No. 04(29), 131-136. https://scholar.dlu.edu.vn/thuvienso/bitstream/DLU123456789/276521/1/CVv266S04A2024131.pdf

Carril-Caccia, Federico, (2025). The impact of economic sanctions on bilateral mergers and acquisitions, European Journal of Political Economy, Elsevier, vol. 86(C). https://doi.org/10.1016/j.ejpoleco.2025.102650.

Dang Huu Man & Nguyen Manh Toan (2023). The Impact of Policy Uncertainty on Stock Liquidity in Vietnam's MA Market. Journal of Science and Technology, Vol. 21, No. 6.1. https://doi.org/10.31130/ud-jst.2023.117E

Emily Nguyen. (2025). Asymmetric Market Efficiency in Vietnam's Emerging Capital Markets: Panel Data Evidence from Cross-Border M&A Announcement Effects on Stock Volatility Dynamics. Journal of Economics, Finance and Management Studies. https://doi.org/10.47191/jefms/v8-i7-83

Fahlevi, A. R., Frensidy, B., Hermawan, A. A., & Mita, A. F. (2025). What can we learn from mergers and acquisitions (M&A) in ASEAN? The role of family ownership and accounting conservatism. Cogent Business and Management, 12(1). https://doi.org/10.1080/23311975.2025.2580684

Florian Ottoa, Joelson Oliveira Sampaiob, Vinicius Augusto Brunassi Silvac. (2020). Domestic and cross-border effect of acquisition announcements: A short-term study for developed and emerging countries. Finance Research Letter. https://doi.org/10.1016/j.frl.2020.10150

Hoang Chi Cuong, Tran Thi Nhu Trang, and Dong Thi Nga. (2015). Do Free Trade Agreements (FTAs) Really Increase Vietnam’s Foreign Trade and Inward Foreign Direct Investment (FDI)? Journal of Economics, Management and Trade 7 (2):110–127. https://doi.org/10.9734/BJEMT/2015/16253.

Hong-Hai Ho, Thi-Hanh Vu, Ngoc-Tien Dao, Manh-Tung Ho, and Quan-Hoang Vuong (2019). When the Poor Buy the Rich: New Evidence on Wealth Effects of Cross-Border Acquisitions. Journal Risk and Financial Management. https://doi.org/10.3390/jrfm12020102

Hosseini, Thu & Trang. (2017). Vietnam Inbound M&A Activity: The Role of Government Policy and Regulatory Environment. The South East Asian Journal of Management. https://doi.org/10.21002/seam.v11i1.7738

Khoa Bui, Tu Le & Thanh Ngo, (2025). Drivers of Merger and Acquisition Activities in Vietnam: Insights from Targets’ Perspectives and Deal Characteristics, IJFS, MDPI, vol. 13(1), pages 1-20, February. https://doi.org/10.3390/ijfs13010019.

Ma, J., Pagan, J. A., & Chu, Y. (2012). Wealth Effects of Bank Mergers and Acquisitions in Asian Emerging Markets. Journal of Applied Business Research (JABR), 28(1), 47–58. https://doi.org/10.19030/jabr.v28i1.6683

Minh-Ha Luong. (2023). M&A Advisors in Vietnam Emerging Market 2000 – 2022. Journal of Economics, Finance and Management Studies. https://doi.org/10.47191/jefms/v6-i6-46.

Minh-Ha Luong & Thanh Trung Nguyen. (2024). Mergers and Acquisitions Activities in Vietnam Consumer Goods Sector 2000 – 2022 and The Role of Advisors. International Journal of Multidisciplinary Research and Analysis. https://ijmra.in/v7i3/55.php

Nga Pham, K.B. Oh, Richard Pech. (2015). Mergers and acquisitions: CEO duality, operating performance, and stock returns in Vietnam. Pacific-Basin Finance Journal, Volume 35, Part A, Pages 298-316. https://doi.org/10.1016/j.pacfin.2015.01.007

Nguyen, T. T., & Ha, T. H. N. (2017). Serial acquisitions: A Case Study of Saigon – Hanoi Commercial Joint Stock Bank. Journal of International Economics and Management, 94, 74-88. https://jiem.ftu.edu.vn/index.php/jiem/article/view/169

Nguyen Thi Hong Nham, Vu Thang Thinh, and Duong Nu Quy Dan (2024). Information environment and strategy of mergers and acquisitions: Evidence from Vietnamese companies’ deals. Resilience By Technology and Design. https://doi.org/10.2991/978-94-6463-583-6_21.

Pham H, Mudalige P, Le H, Bui M, Nguyen V, Ramiah V, et al. (2024). The effects of free trade agreements on the stock market: Evidence from Vietnam. PLoS ONE 19(2): e0294456. https://doi.org/10.1371/journal.pone.0294456

Quyen Van & Vy Tran, (2023). Control of Emerging-Market Target, Abnormal Stock Return: Evidence in Vietnam, Papers 2302.07117, arXiv.org, revised Mar 2023. https://ideas.repec.org/p/arx/papers/2302.07117.html.

Quyet, N. (2022). Macroeconomic Factors Affecting Merger and Acquisition (M&A) Activity in Vietnam. In: Nguyen, A.T., Hens, L. (eds) Global Changes and Sustainable Development in Asian Emerging Market Economies Vol. 1. Springer, Cham. https://doi.org/10.1007/978-3-030-81435-9_31

Ridwan, M., Suhar, A., Ulum, B., & Fauzi, M. (2021). Pentingnya Penerapan Literature Review pada Penelitian. Jurnal Masohi, 2(1), 42-51.

Tarigan, L. Y. P. & Michelle, M. (2022). Analysis of Financial Performance from Synergistic Value Pre and Post Merger and Acquisition, Jurnal Ekonomi, Volume 11, No 01 June, 553-566. https://ejournal.seaninstitute.or.id/index.php/Ekonomi/article/download/305/265

Trang Cam Hoang, Huy Pham, Vikash Ramiah, Imad Moosa, & Danh Vinh Le. (2020). The effects of information disclosure regulation on stock markets: Evidence from Vietnam. Research in International Business and Finance. https://doi.org/10.1016/j.ribaf.2019.101082

Copyright (c) 2025 Zerahya Kenanya, Dea Nur Ramadhaning, M. Faizal Baihaqqi, M. Harit Farizi, Omair Davy Zakaria Nurdin , Diah Hari Suryaningrum

This work is licensed under a Creative Commons Attribution 4.0 International License.