Sustainable Profitability with Assets Management Analysis: A Case Study of PT Tri Ananda Pratama Balikpapan – Indonesia

Abstract

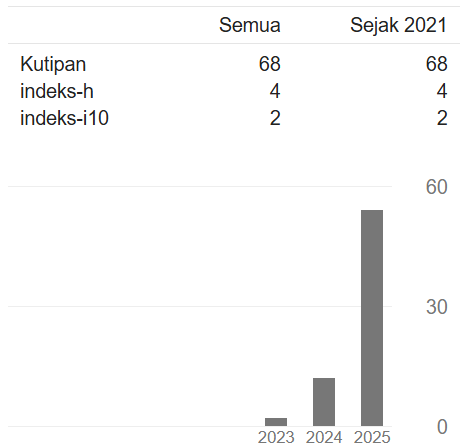

The company's operational activities aim to generate profits to survive and be competitive. Efforts to generate maximum profits cannot be separated from the effective use of company assets The objective of this study is to assess asset management at PT. Tri Ananda Pratama Balikpapan from the perspectives of receivables, inventories, fixed assets, total assets, and working capital turnover to sustain sustainable profitability as determined by net profit margin (NPM) from 2017 to 2019. Ratios are used by the analytical tool; the activity ratio, which includes the working capital, fixed asset, inventory, and account receivable turnover ratios, is one type of ratio that is used. In addition, the net profit margin (NPM) ratio is employed to assess the ongoing profitability of the business. The research results demonstrate that total asset turnover, inventory, fixed assets, and accounts receivable can all raise NPM. However, NPM cannot be raised by working capital turnover. Based on the research results, it is implied that companies can optimize their use by detailing and understanding the needs and life cycle of assets. This will help reduce waste and increase operational efficiency.

Downloads

References

Amanda, N., Sahabuddin, R., & Nurman, N. (2023). Working Capital Turnover Analysis of Profitability Levels at PT Semen Indonesia (Persero) Tbk. Economics and Business Journal (ECBIS), 1(4), 285–292. https://doi.org/10.47353/ecbis.v1i4.41

Brigham, E. F., & Houston, J. F. (2019). Principles Of Managerial Finance Management, 11th Edition. New York: Pearson.

Chandra, A., Wijaya, F., Angelia, & Hayati, K. (2021). Pengaruh Debt to Equity Ratio, Total Assets Turnover, Firm Size, dan Current Ratio terhadap Return on Assets. Jurnal Akuntansi, Keuangan, dan Manajemen, 2(1), 57–69. https://doi.org/10.35912/jakman.v2i1.135

Deo, P. (2021). Fixed Asset Management – Revisited. Journal of Accounting and Finance, 21(1), 10–22. https://doi.org/10.33423/jaf.v21i1.4155

Fadila, R. N., & Suryaningrum, D. H. (2023). Fixed Assets Account Audit Procedures at the YG Community Health Center. Sustainable Business Accounting and Management Review, 5(2), 14–25. https://doi.org/10.61656/sbamr.v5i2.70

Gavrikova, E., Volkova, I., & Burda, Y. (2020). Strategic Aspects of Asset Management: An Overview of Current Research. Sustainability, 12(15), 5955. https://doi.org/10.3390/su12155955

Hidayati, W., Rizal, N., & Taufiq, M. (2019). Analisis Perlakuan Akuntansi Aset Tetap Pada Koperasi Serba Usaha Manda Group Berdasarkan PSAK No.16. Progress Conference, 2(1), 672–679. http://proceedings.itbwigalumajang.ac.id/index.php/progress/article/view/179

Jasmani, J. (2019). The Effect of Liquidity and Working Capital Turnover on Profitability at PT. Sumber Cipta Multiniaga, South Jakarta. PINISI Discretion Review, 3(1), 29–38. https://doi.org/10.26858/pdr.v3i1.13269

Kasmir. (2014). Analisis Laporan Keuangan. Raja Grafindo Persada.

Krylov, E. I., Vlasova, V. M., & Vorobiova, L. S. (2020). Fixed Assets Turnover Ratio Factor Analysis For Hi-Tech Equipment. International Conference on Economic and Social Trends for Sustainability of Modern Society (ICEST May 2020), 1295–1301. https://doi.org/10.15405/epsbs.2020.10.03.149

Kwak. (2019). Analysis of Inventory Turnover as a Performance Measure in Manufacturing Industry. Processes, 7(10), 760. https://doi.org/10.3390/pr7100760

Listalia, D., & Suryaningrum, D. H. (2023). Implementation of Audit Procedures for Inventory Accounts at the Melati Putih Health Center. Sustainable Business Accounting and Management Review, 5(2), 1–13. https://doi.org/10.61656/sbamr.v5i2.71

Manullang, A. E. A., Togatorop, D., Purba, P. R. D., Manik, E. A. Y., Simorangkir, E. N., & Lase, R. K. (2020). The Significance of Accounts Receivable Turnover, Debt to Equity Ratio, Current Ratio to The Probability of Manufacturing Companies. International Journal of Social Science and Business, 4(3), 464–471. https://doi.org/10.23887/ijssb.v4i3.27874

Muftinisa, A., Rosalina, Ginanjar, R., Wahyu, R. B., & Hadisukmana, N. (2017). Development and implementation of fixed asset management system. 2017 Second International Conference on Informatics and Computing (ICIC), 1–6. https://doi.org/10.1109/IAC.2017.8280591

Petchrompo, S., & Parlikad, A. K. (2019). A review of asset management literature on multi-asset systems. Reliability Engineering & System Safety, 181, 181–201. https://doi.org/10.1016/j.ress.2018.09.009

Putri, K., & Suryaningrum, D. H. (2023). Analisis Pengaruh Materialitas terhadap Profitabilitas, Solvabilitas, Likuiditas dengan SDGs Sebagai Variabel Mediasi. Journal of Economic, Public, and Accounting (JEPA), 6(1), 28–40. https://ojs.unsulbar.ac.id/index.php/jepa/article/view/2893.

Simorangkir, R. T. M. C. (2019). The Effect of Working Capital Turnover, Total Asset Turnover, Debt to Equity Ratio, Audit Committee, and Board of Directors on Tobins Q. Saudi Journal of Business and Management Studies (SJBMS), 4(7), 619–628. https://doi.org/10.36348/sjbms.2019.v04i07.010

Sutrisno, S. (2019). Manajemen Keuangan. Jakarta: Ekonisia.

Wild, J. J., & Subramanyam. (2018). Analisis Laporan Keuangan. Edisi Kesepuluh. New York: McGraw-Hill.

Yulianto, R., & Suryaningrum, D. H. (2019). Differences in the Financial Performance before and after Revaluation of Fixed Assets. Sustainable Business Accounting and Management Review (SBAMR), 1(2), 53–62. https://doi.org/10.61656/sbamr.v1i2.29.

Copyright (c) 2023 Ersalina Ballinda, Elfreda Aplonia Lau, Ekrin Yohanes Suharyono

This work is licensed under a Creative Commons Attribution 4.0 International License.